Frequently Asked Questions*

FAQ’s

-

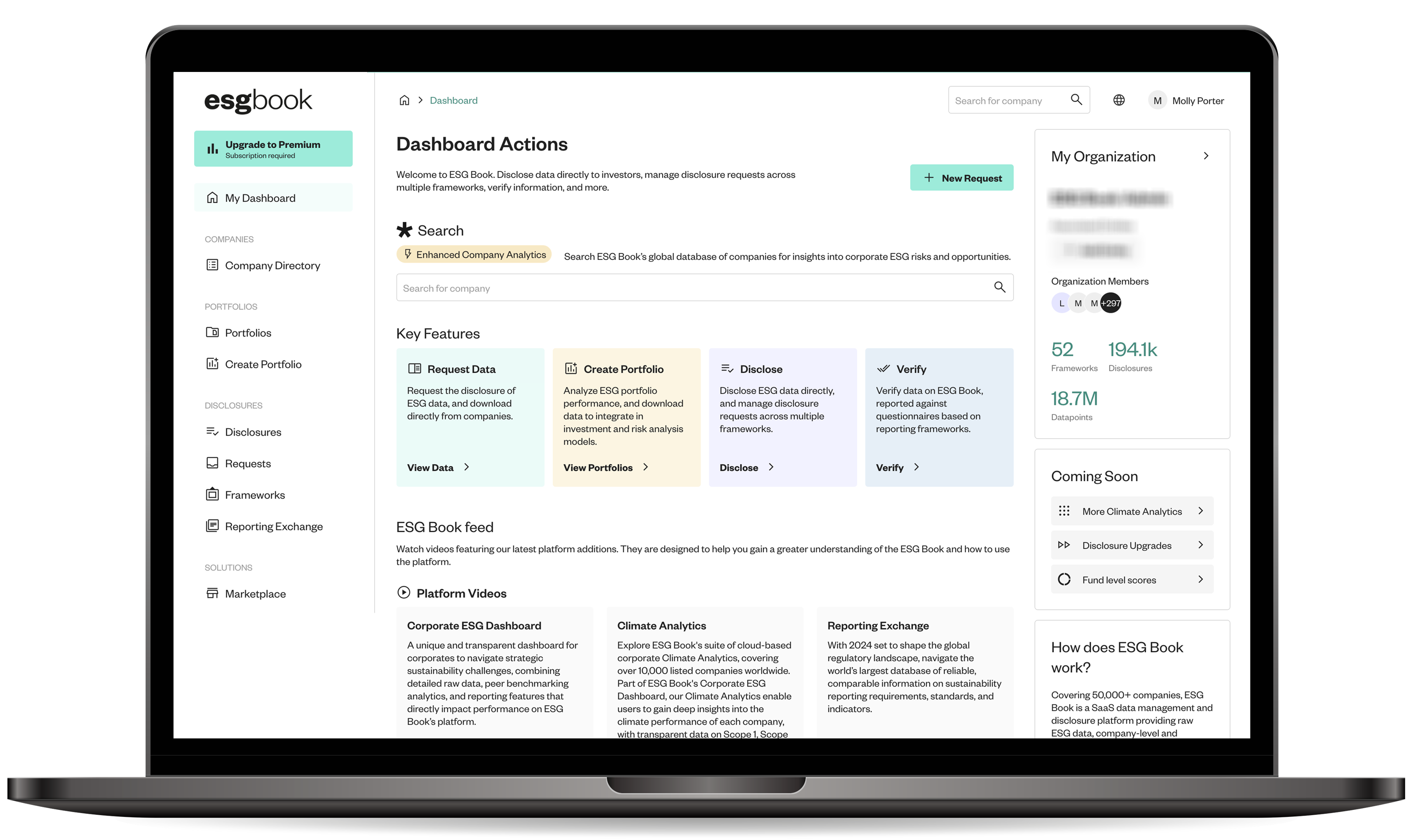

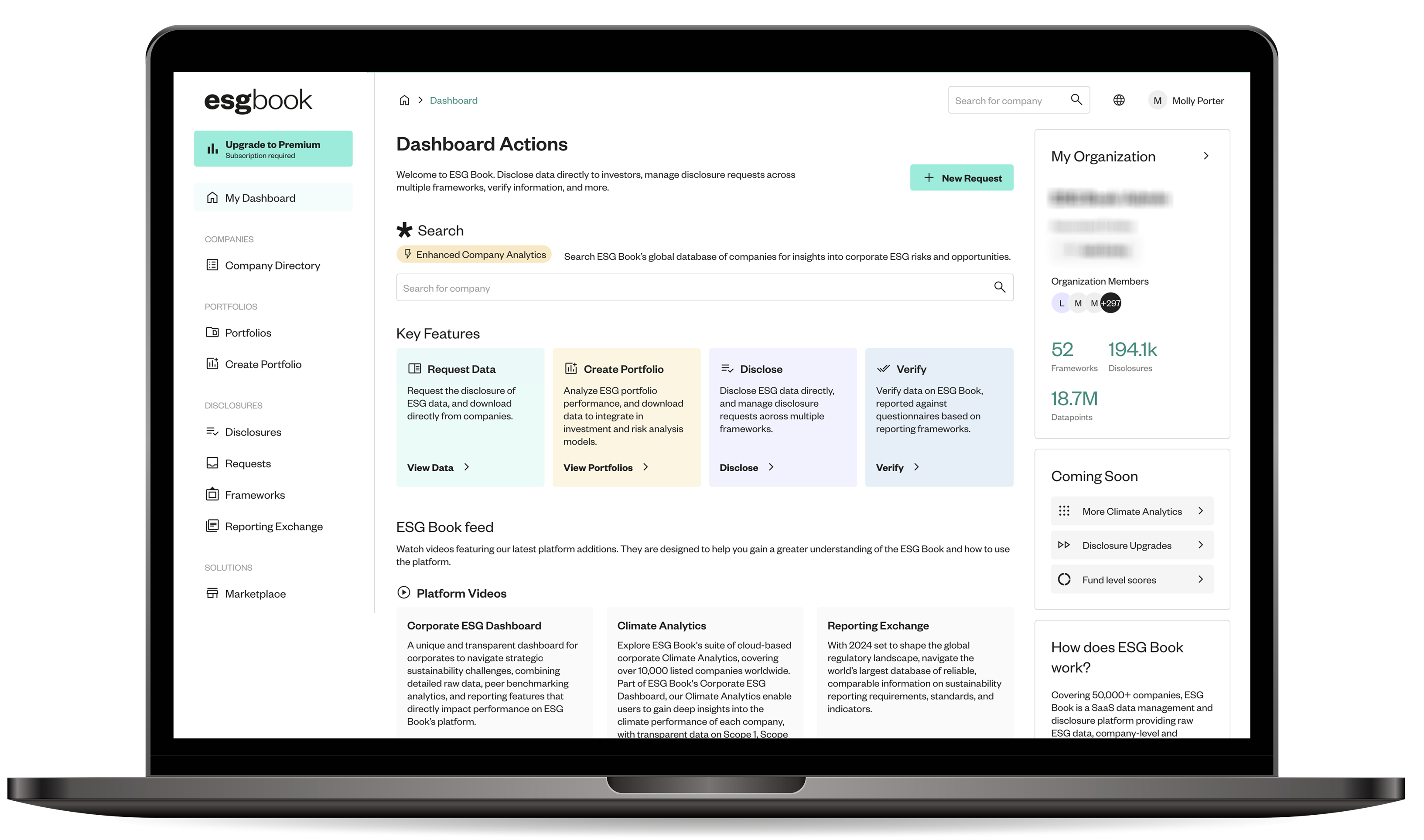

ESG Book LEO is a single source solution, interoperable with other frameworks, enabling companies to efficiently report sustainability data to multiple financial institutions for disclosure and regulatory requirements.

-

Sustainability data is increasingly critical for financial institutions to conduct robust climate risk assessment, undertake client due diligence, meet regulatory requirements, track progress towards climate commitments, develop transition plans, and engage with clients.

However, inefficient sourcing of data is coupled with multiple, divergent, non-structured data sources that lack comparability and verification.

Companies receive various data requests from multiple institutions in different formats, resulting in a reporting burden. Disclosure mechanisms are not centrally managed, and financial institutions are not efficiently leveraging data already in the public domain.

With a single, harmonized and modular approach to data collection and validation, ESG Book LEO provides a solution to these inefficiencies.

-

Through ESG Book LEO, companies are empowered with a single technology platform, interoperable with other climate data templates and technology systems, to facilitate reporting once and serving multiple financial institutions.

- Accelerated Regulatory Reporting: The ESG Book LEO framework is grounded in datapoints that contribute to the global baselines companies need to disclose against for regulatory reporting.

- Better Disclosure Experience: Data requests to companies are streamlined and standardized across multiple financial institutions, providing a single interface to disclose once and share data with various stakeholders.

- Reduced Reporting Burden: Data pre-population functionality captures sustainability information collected by ESG Book in the public domain for immediate use by companies in their response.

- Built for Interoperability: Existing public data is pre-populated for a company's convenience while remaining interoperable with other public data initiatives such as NZDPU.

-

ESG Book LEO brings a streamlined approach to sustainability data sourcing and reporting for financial institutions.

- Standarized Reporting: Financial institutions can gather climate data in a standardized format, evidenced by companies.

- Frictionless Approach: ESG Book LEO is a single access point that streamline data requests and tracks clients’ disclosure progress.

- Network Effect: Data overlap from clients and suppliers increases data response rates for financial institutions.

- Greater Efficiency: ESG Book LEO reduces the workload for relationship managers in data collection through technology.

-

ESG Book LEO has been developed by ESG Book, in partnership with Google Cloud and Boston Consulting Group, to bring a unique, harmonized approach to sustainability data sourcing and reporting.

-

ESG Book LEO is built to be interoperable with other leading sustainability data frameworks, with the aim of simplifying and streamlining climate data disclosure for companies, without adding to the reporting burden.

-

ESG Book LEO uses data templates, developed by BCG, which align to existing disclosure standards and meet the requirements for financial institutions in a streamlined fashion.

The modularity of the templates means the level of detail requested is adjustable to each client’s reporting maturity, with industry specific questions for hard-to-abate industries.

-

Participating companies are requested to respond to streamlined climate risk data modules, aligned to global sustainability disclosure standards, which cover indicators such as a company’s greenhouse gas emissions, emission targets, and climate transition plans. This data is requested due to banks’ regulatory requirements, which also align to the dominant corporate reporting standards and frameworks (for example, EBA Pillar 3, EU Taxonomy, ISSB, and TCFD).

-

Companies have full control over their reported data and can select who can view the data disclosed on the platform by making a specific disclosure either public or private.

-

ESG Book LEO does not require all data points within a given module to be filled in by a company before submitting a disclosure. However, a participating financial institution may communicate a list of required data points in advance.

-

Guidance around the required data inputs is provided for all metrics on the platform. All further queries can be directed to the support desk (insert link) of ESG Book through the platform.

-

Companies invited to disclose are not obligated to participate. However, sustainability-related regulatory reporting is increasingly becoming a mandatory requirement worldwide, and ESG Book LEO is built to support companies to accelerate their reporting capabilities.

-

While this will vary across companies, investor relations, external reporting, or sustainability teams are most likely to be best placed to provide the relevant climate data requested.

-

The disclosed climate data of participating companies can be used by financial institutions for use cases including:

- Compliance with regulatory reporting requirements.

- - Climate risk assessments of portfolios.

- - Analysis and reporting around the emissions footprint of the client base.

- - Engagement on climate transition plans.

- - Client advisory services, financing solutions, and communications.

-

Developed in partnership with Google Cloud, ESG Book LEO is built to be compliant with the software security requirements of financial institutions.

Companies are fully in control of who can view the data they submit on ESG Book's platform. Through Google Cloud’s cloud infrastructure and ESG Book’s rigorous security procedures, all data submitted to ESG Book LEO is securely maintained and permissioned depending on the company’s sharing privileges of their disclosure.

-

Since the information will be used for regulatory reporting purposes and will likely underpin an existing contractual relationship with the requesting financial institution, companies are encouraged to submit data that is timely and accurate.

-

No. However, the requesting financial institution may communicate the expected response time bilaterally with the reporting company.

-

The amount of time needed to complete a disclosure on ESG Book LEO depends on the data module selected for response. As an example, the module with the fewest number of questions, the ESG Book LEO Essential module, consists of up to 40 questions covering basic company information, greenhouse gas emissions, climate commitments, targets, and transition plans.

These metrics are aligned with reporting standards such as ISSB, ESRS, TCFD and the SEC draft on climate disclosures. Filling out the ESG Book LEO Essential module questionnaire, assuming all data is readily available internally to a company, can be completed within a few hours.

Other time variables for completing the module/s may include:

- The extent of data pre-populated from ESG Book's historical dataset which is collected from public sources.

- The existing availability of climate data points internally to a company's reporting.

- Internal company capacity and resources.

-

To learn more about ESG Book LEO, email: [email protected]

The Solution

A unique, industry-backed solution for companies disclosing sustainability data to financial institutions.

The Template

Find out how the template streamlines the climate data companies are asked to provide to financial institutions.

Contact Us

Contact us to learn more about ESG Book’s solutions